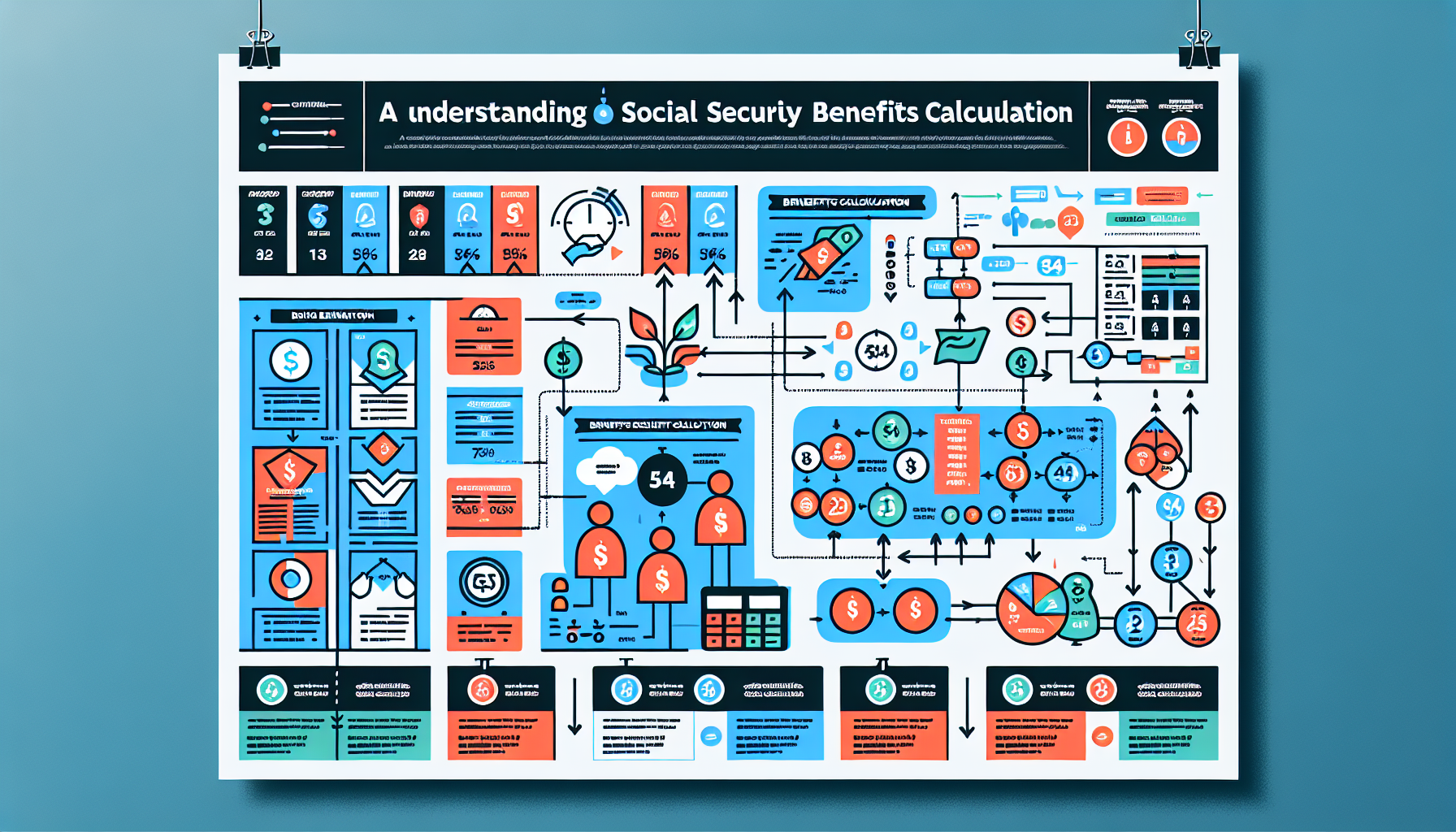

Understanding Social Security Benefits: A Comprehensive Guide

Have you ever wondered how your Social Security benefits are calculated? If you’re approaching retirement age, this is crucial information that can make a significant difference in your financial future. Today, we’ll break down the steps involved in determining your Social Security benefits so you can make informed decisions for your retirement.

Step 1: The Importance of Indexing Lifetime Earnings

Before you can even think about the numbers, it's essential to recognize that Social Security benefits hinge on your lifetime earnings. The calculation begins by adjusting these earnings to reflect changes in wage levels over time, a process known as indexing. This ensures that your retirement benefits are in line with inflation and the overall rise in living standards.

For instance, if you’re eligible for retirement in 2025, the Social Security Administration (SSA) utilizes the Average Wage Index (AWI) to adjust earnings from years before you turned 60. Imagine a hypothetical worker who earned $50,000 in 2022 and $45,000 in 2021. The SSA would divide the AWI for 2023 by that of previous years and adjust the earnings accordingly, ensuring they're reflective of today’s economic environment.

Step 2: Identifying the 35 Highest-Paid Years

Once your earnings have been indexed, the SSA identifies the 35 years in which you earned the most. This may seem simple, but it’s vital for determining what your Average Indexed Monthly Earnings (AIME) will be. If you’ve consistently earned a good salary throughout your career—let’s say $100,000 or more in many of those years—your monthly benefit will reflect that.

For example, if you have 35 years of high earnings and your total indexed earnings come to $3 million, your average monthly earnings would be calculated by dividing that total by 420 (the number of months in 35 years), resulting in an AIME of $7,142.86.

Step 3: Applying the Benefits Formula

Now, here’s where it gets a bit intricate. The SSA applies a specific formula to your AIME to establish your Primary Insurance Amount (PIA). This formula considers three "bend points" and takes a percentage of your AIME at various levels.

For instance, if for those who become eligible in 2025, the bend points are set at $1,226 and $7,391, a retiree with an AIME of $10,000 would calculate their PIA as follows:

- 90% of the first $1,226

- 32% of the amount between $1,226 and $7,391

- 15% of the amount above $7,391

In this scenario, the PIA from an AIME of $10,000 would be approximately $3,467.55.

Step 4: Adjusting PIA for Retirement Age

Finally, the calculated PIA isn’t the end of the story. The amount you receive can vary depending on when you choose to claim your benefits. If you retire early at age 62, your benefits could be reduced to less than your PIA. On the other hand, if you wait until age 70 to claim, you will receive an increased benefit.

It’s crucial to note that adjustments also account for inflation via Cost-of-Living Adjustments (COLA), which are applied annually, starting at age 62, regardless of whether you’ve claimed benefits or not.

Conclusion: Making Informed Choices

In conclusion, understanding how your Social Security benefits are calculated can empower you to make smarter decisions about your retirement. Whether you’re contemplating when to claim or considering your career choices in your earlier years, this knowledge can significantly impact your financial stability in retirement. After all, being informed is the first step toward financial independence and peace of mind!

If you're curious about the latest trends in retirement planning or would like personalized guidance, don’t hesitate to join our community at The Motley Fool for valuable insights and recommendations. Happy planning!